Over the past week, there has been a great deal of media coverage regarding the recent catastrophic collapse of Silicon Valley Bank, both in general news outlets and within the crypto space. This post aims to summarize the events leading up to the bank's collapse on March 10th, 2023, as well as offer insights into whether there is a legitimate systemic risk of the banking system collapsing as we know it.

Background Facts on Silicon Valley Bank

Various articles have cited different figures for the amount of uninsured deposits and assets held by Silicon Valley Bank. To gain a more accurate understanding of their financial situation, let's take a look at the exact numbers.

At the time the FDIC placed SVB's bank in receivership, the bank had the following:

$21 billion (USD) in insured deposits

$152 billion (USD) uninsured deposits.

$173 billion (USD) total deposits

$116 billion invested in securities (10Y Treasury Bonds + Mortgage Backed Securities)

Additionally, SVB incurred a net loss of $25 billion in deposits in 2022, which increased to $30 billion by March 2023.

What Led to the Bank Run

The reasons behind the collapse of Silicon Valley Bank are complex, with several factors playing a critical role. A closer examination of each contributing element reveals that SVB's demise was unusual for a variety of reasons.

Firstly, it should be noted that SVB's troubles began before Peter Thiel became a relevant factor in the conversation. The bank was prompted to take action, including selling $21 billion in 10-Year Treasury Bonds and suffering a $2 billion impairment, only after being contacted by credit rating agency Moody's.

In a mid-quarter update published on March 8th, 2023, shortly before it was placed into receivership, SVB noted (see screenshot above) that they were in dialogue with Moody's, a credit rating agency.

According to a report by Reuters on March 11th, 2023, a phone call between Moody's and executives at SVB's parent company, SVB Financial Group, in which Moody's conveyed concerns similar to those noted in the screenshot above, is what ultimately triggered the chain of events leading to SVB's placement into receivership by the FDIC on March 10th.

According to a report, SVB Chief Executive Greg Becker's team sought advice from Goldman Sachs Group Inc bankers and flew to New York for meetings with Moody's and other ratings firms. Based on the given timeline, it appears that Moody's was in contact with SVB the week before they were ultimately placed into receivership.

The report further states that SVB worked on a plan over the weekend to boost the value of its holdings. The plan involved selling over $20 billion worth of low-yielding bonds and reinvesting the proceeds in assets with higher returns.

In the week following that conversation, executives received notification from Moody's that the downgrade was imminent, prompting them to take immediate action to rectify the situation.

Moody's Questionable Behavior

Without rehashing the mortgage crisis that led to the 2008 recession, one oft-stated criticism is that the ratings agencies played an integral in 'hiding' the burgeoning credit default risk of billions of dollars worth in mortgage-backed securities.

This was done by rating certain bonds (CDOs) with a grade of 'A', which conveyed a low to non-existent risk of default. In reality, things were much different.

In the case of SVB, it appears that the same thing happened here. The Reuters report goes on to note that, initially, "Moody's downgraded the bank, but only by a notch because of SVB's bond portfolio sale and plan to raise capital."

It should have been immediately evident, and concerning, that the bank was at risk of default, given the mid-quarter update it published. The update included a note stating that Moody's was still considering adjusting its rating of the bank downward and by how much. It is reasonable to assume that Moody's had the opportunity to review the report with its opaque updated financials and quickly conclude that the bank was in an extremely distressed financial position.

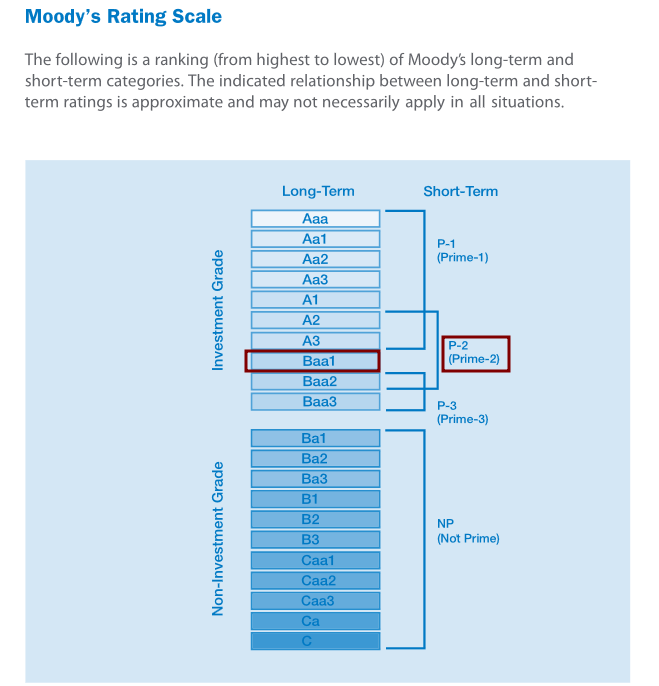

Nonetheless, Moody's only downgraded SVB Financial's senior unsecured to Baa1 from A3. This suggests that the rating agency may have failed to adequately assess the bank's risk, contributing to its eventual collapse.

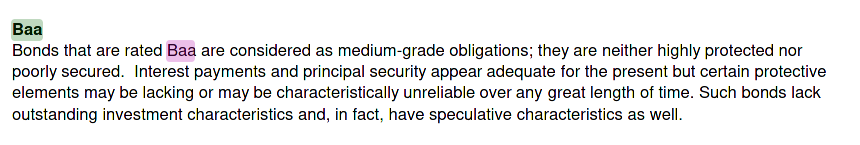

Explaining the Baa1 Rating for Unsecured Senior Debt

The 'Baa1' rating falls within the lower end of the investment-grade category, which includes ratings from 'Aaa' to 'Baa3.' A 'Baa1' rating indicates that the bank's senior unsecured debt is considered to be of medium-grade quality and carries moderate credit risk.

However, the bank's ability to meet its financial commitments is still relatively strong, but more susceptible to adverse economic conditions or changing circumstances than higher-rated issuers.

In summary, a 'Baa1' rating from Moody's on a bank's senior unsecured debt means that the bank is considered to have a moderate credit risk, but its ability to fulfill its debt obligations is still relatively strong compared to lower-rated issuers. Investors in the bank's senior unsecured debt can expect a slightly higher yield compared to higher-rated debt, given the increased risk associated with the 'Baa1' rating.

This change in rating came nowhere close to portraying the reality of SVB's financial situation at the time. As to whether this exacerbated the bank's eventual demise or not remains to be seen. But in light of what we now know to be true of the 2008 Global Recession which was triggered by a burgeoning banking crisis, this abject failure to properly capture the financial risk of SVB warrants scrutiny.

Mid-Quarter Update

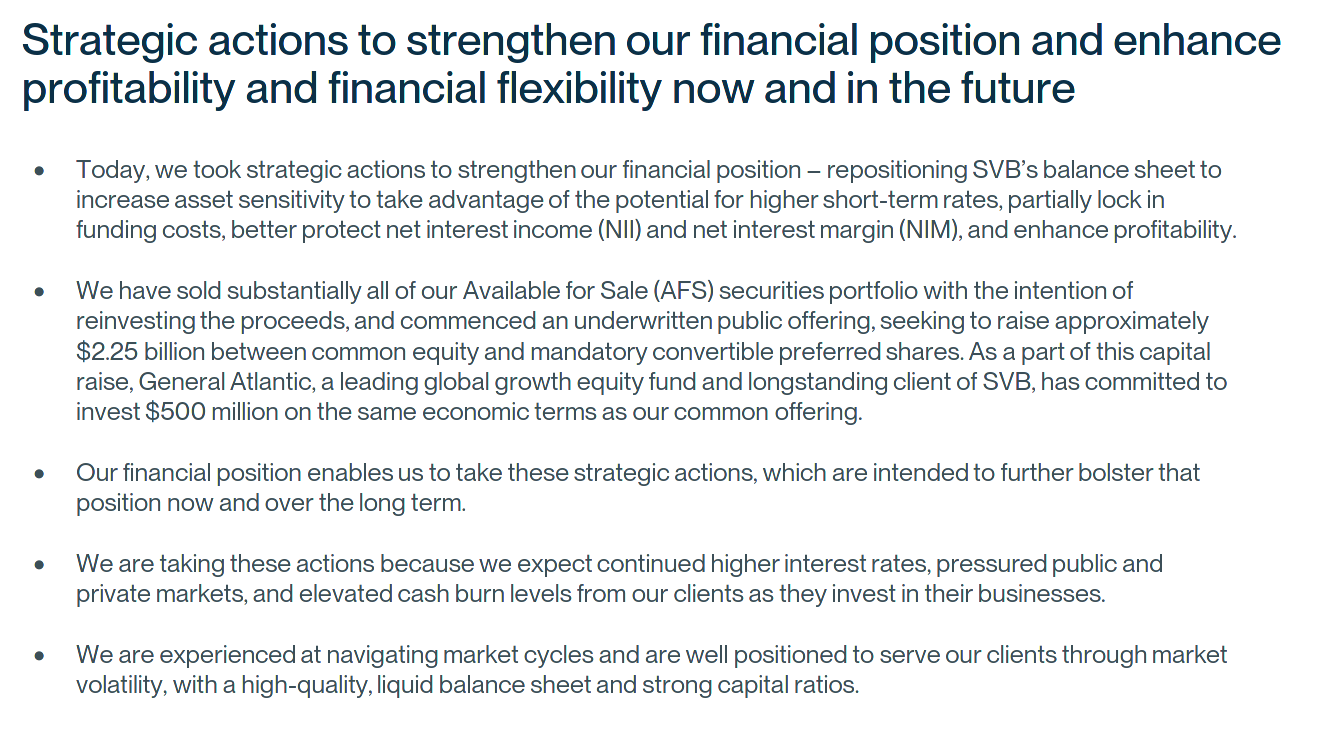

On March 8th, 2023 (Wednesday), SVB released a 'mid-quarter update' for Q1 2023.

The update kicks off with an itemized list of "strategic actions to strengthen our financial position and enhance profitability and financial flexibility now and in the future."

Notably, among these 'strategic actions', SVB indicates they "sold substantially all of our Available for Sale (AFS) securities portfolio to reinvest the proceeds, and commenced an underwritten public offering, seeking to raise approximately $2.25 billion between common equity and mandatory convertible preferred shares."

They also note that, "we are taking these actions because we expect continued higher interest rates, pressured public and private markets, and elevated cash burn levels from our clients as they invest in their businesses."

In laymen's terms, SVB made it clear they:

Sold all of their AFS securities (10Y treasury bonds)

Suffered some amount of impairment, forcing them to seek a $2.25 billion fundraise, funded both through the sale of common equity (shares) and mandatory convertible preferred shares (debt financing).

"Continued higher interest rates" and "elevated cash burn levels from our clients as they invest in their businesses" spell out for us that the problem was rooted in SVB being underwater on their securities assets while simultaneously suffering a liquidity crunch caused by a greater than expected net deposit outflow.

As we can see above:

SVB sold $21 billion in 10Y Treasury Bonds. The '3.6-year duration' denotes that the bonds were purchased 3.6 years prior to the date of the sale. If we do the math, that dates us back to September 2019 (a few months before the onset of the global pandemic).

This sale of $21 billion worth of 10Y Treasury Bonds resulted in a $1.8 billion impairment. These assets are mark-to-maturity, not mark-to-market (concept we will discuss), which means that the losses accrued in this asset allocation as inflation and interest rates rose were previously unrealized.

SVB was looking to take on $500 million in debt/equity financing (this is a hybrid fundraising vehicle (convertible preferred stock) and another $500 million more from General Atlantic in a restricted stock sale (also debt). As we'll see below, the remaining $1.25 billion in common stock they were looking to sell falls under 'equity financing'.

Below are Details Concerning the $1.25 Billion Sale of Common Stock

Below are Details Concerning the $500 Million Sale of Convertible Preferred Stock

Peripherally mentioned above is the fact that SVB also increased its term borrowings from $15B to $30B (tacking on an additional $15 billion in debt on top of their fire sale of $21 billion in Treasury Bonds and another $2 billion in shares).

As we'll see below, SVB had yet to hedge these 'term borrowings' (additional $15 billion), to "lock-in borrowing costs".

Here We'll See SVB's Progress on Their Objectives as of March 8th, 2023:

Why Uninsured Depositors Got Spooked

Below, we can see the numbers that triggered a bank run by uninsured depositors (this is where shit gets ugly).

There's a lot here - so let's unpack everything one by one.

Examining the total amount of 'Fed Cash' On-Hand for SVB

Above, we can see that the additional ~$15 billion in 'Fed Cash' has been accounted for.

Fed Cash, or Federal Reserve Cash, refers to the funds held by banks at the Federal Reserve. When a bank needs short-term liquidity, it can borrow funds from the Federal Reserve's discount window. These loans do come with an interest rate attached to them, known as the discount rate.

The discount rate is set by the Federal Reserve and can vary depending on economic conditions and monetary policy objectives. At the time SVB executed their 'strategic' moves, the 'discount rate' for these funds was 4.75%.

Also worth noting by Investopedia, "The discount rate is set higher than the fed funds rate, and is intended to be used as a last resort for banks who are unable to borrow in the 'interbank market'. The secondary discount rate is an even higher discount window rate of interest for Fed loans made to banks that are struggling with liquidity."

Also, "borrowing from the central bank is a substitute for borrowing from other commerical banks, and so it is seen as a last-resort measure."

The terms of repayment for loans from the Federal Reserve's discount window can vary depending on the type of credit being extended. There are typically three types of credit provided by the discount window:

Primary Credit: This type of credit is extended to financially sound banks and is typically provided on a very short-term basis, often overnight. The interest rate on primary credit is usually set above the Federal Funds rate target.

Secondary Credit: This type of credit is extended to banks that do not qualify for primary credit, often due to financial issues. Secondary credit is provided on a short-term basis, and the interest rate is generally set higher than the primary credit rate.

Seasonal Credit: This type of credit is designed to address seasonal fluctuations in the borrowing needs of smaller banks. The interest rate on seasonal credit is typically a floating rate based on market rates.

The rates for each of these types of loans obtained directly from the Federal Reserve can be found on its site.

The rates shown above were made effective on February 2nd, 2023, and are the same for all major major districts (including California). It is unknown whether SVB obtained a first or secondary rate.

Assuming it was a secondary rate, they'd owe approximately $787.5 million in interest. With that in mind, let's go take a look at the remaining cap in additional funds SVB was allowed to borrow from the federal government.

As we can see above, the total capacity listed above (~$95 billion), denotes 'primarily FHLB and repo'. FHLB stands for the "Federal Home Loan Banks", and its job is to 'provide members with liquidity'.

According to the FDIC's site, "FHLBs cap the amount of advance credit available to each member at between 20 and 60 percent of the member's total assets."

With that in mind, it appears that SVB had not paid back the principal on the first $15 billion outstanding loan from the FHLB since the remaining amount that could be borrowed was down to $65 billion at the time the mid-quarter report was published ($30 billion less than the listed cap of $95).

What's worth mentioning is an excerpt from the FHLB's page on the FDIC website that states, "Advances are secure by mortgages held in portfolio and other eligible types of collateral that the FHLB holds."

In the aftermath of the SVB collapse, we know that the bank was holding $75.5 billion worth of residential mortgage-backed securities (RBMS) along with another $15.9 billion of commercial mortgage-backed securities.

However, worth noting is the fact that those mortgage-backed securities were valued at $91.4 billion marked-to-maturity. However, their marked-to-market value was only $76 billion at the time the bank actually collapsed (amounting to an unrealized impairment of $15 billion total).

As Barron's and others have noted, this loss (by itself) was enough to completely evaporate the bank's $16 billion equity base. Despite the dire situation that this put the bank in, its CEO (Greg Becker), "appeared at a Morgan Stanely conference on March 7 and got no questions about the bank's balance sheet, deposits, or securities portfolio."

Reconstructed AFS portfolio

On the sheet, SVB conveyed they had ~$25 billion in short duration U.S. Treasury assets.

However, if we read the fine print (literally), we'll see that the "AFS portfolio reconstruction includes the sale of $21 billion AFS securities executed on March 8, 2023 and reinvestment in short-duration USTs hedged with receiving-floating swaps."

For what it's worth, GPT-4 was consulted about whether it could be considered ethical or fair practice for the bank to include this value as part of its "available" liquidity base on March 8th, 2023, despite their failure to actually acquire those assets at that point in time.

Summarizing the Issues Leading to the SVB Meltdown

As GPT-4 observed, one of the contributing factors to the bank's demise was likely their insistence that they had "ample liquidity", specifically stating they possessed a "high-quality, liquid balance sheet with very low loan-to-deposit ratio" and "multiple levers to manage liquidity position to sustain a continued slowdown."

While it is true that the bank had a low 'loan-to-deposit ratio', this was not the crux of their issue. They were not facing impending insolvency due to potential defaults by borrowers. Rather, their issue boiled down to:

Higher than anticipated deposit outflows the year prior due to an increased burn rate by the VC funds and startups (a huge portion of their client base) that bank with them.

Substantial impairment losses suffered due to the dramatic hike in interest rates as well as inflation.

Absolute failure to hedge against the interest rate risk inherent in the large number of fixed-rate securities the bank held on hand.

The fact that these fixed-rate securities accounted for over 50% of the bank's invested deposits.

Bank Run

The market's realization that Silicon Valley Bank was likely insolvent is believed to have been prompted by the publication of this mid-quarter report. Investors likely began to assess the extent of the bank's financial troubles, including the potential losses from its investments in fixed security assets and determined that its liabilities far outweighed its assets.

In reality, this risk is supposed to be reflected by the bank's net interest margin.

The figure of 1.89% as of February 28th, 2023, is particularly noteworthy as it falls significantly below the interest rates of mortgage-backed securities and treasury assets of any duration, which were comparatively higher at 4-5%+. This is interesting as it is widely assumed that an increase in interest rates by the Federal Reserve, which tightens monetary policy, typically results in a positive correlation to net interest margins for banks.

To clarify, net interest margins are the spreads between the interest earned on assets and the interest paid on liabilities, divided by total interest-earning assets. According to the Richmond Fed, when the policy rate increases, banks pay more in interest on their liabilities while the rates on their long-term loans remain stable. This effectively narrows net interest margins.

In the case of Silicon Valley Bank, the relative interest garnered from long-term securities, such as Treasury Bonds and Mortgage-Backed Securities, decreased significantly due to the hike in interest rates. This, in turn, resulted in the bonds representing an unrealized loss, an extreme case for SVB. Given this information, it is worth revisiting the net interest margin for SVB.

It is worth noting that an increase in interest rates by the Federal Reserve would typically have a positive correlation to net interest margins for banks since this allow them to receive more interest on their interest-earning assets while paying out less on their interest-paying liabilities.

However, as the Richmond Fed points out, the opposite can occur if policy rates increase, since banks would be paying out more in interest on their liabilities while the rates on their long-term loans would remain stable. This effectively narrows net interest margins. In SVB's case, the decrease in interest garnered from long-term securities was taken to the extreme, as those securities represented an unrealized loss.

Moreover, SVB had revealed its plan to obtain an additional $15 billion in loans from the FDIC at an interest rate of 4.75-5.25%, which would have increased their total borrowings to $30 billion for the quarter. Since these loans would be counted as liabilities on the balance sheet, their interest rate would be subtracted from the interest rate accrued on assets.

Potential Reasons for Why SVB Executives are Being Investigated

Upon closer examination of SVB's mid-quarter report released on March 8th, 2023, it seems evident that the bank deliberately concealed its actual financial state at that time. The report's section labeled 'Updated Q1'23 Outlook' failed to provide a transparent and genuine updated outlook, as the bank excluded the $21 billion AFS sale of 10-Year Treasury Bonds from their net interest margin calculation. This omission of critical information resulted in a misleading portrayal of the bank's true financial standing.

The bank does the same on the next page of the report.

It seems that the mid-quarter report provided by SVB was intentionally misleading in several aspects. For instance, important financial metrics were displayed in a deceptive manner, and the bank failed to provide a truly updated outlook for its investors. It's unclear at this point how many other ways the bank attempted to obfuscate its true financial health, but further investigation by regulatory authorities will likely reveal more details.

Conclusion

After reviewing the various circumstantial events covered above, it becomes clear that the collapse of Silicon Valley Bank (SVB) was due to a multitude of factors. One of the main catalysts was the bank's risky investment strategy, specifically its heavy reliance on long-term securities such as mortgage-backed securities and treasury bonds.

As interest rates began to rise, SVB's net interest margins were severely impacted, which led to a widening hole in their balance sheet. This, coupled with the fact that they had issued a significant amount of loans without the necessary collateral to back them up, ultimately led to their collapse.

Furthermore, it appears that SVB attempted to obfuscate its true financial health in its mid-quarter report. Key metrics were deceptively displayed and there was a purposeful attempt to hide the true extent of their insolvency. In conclusion, the collapse of SVB was a result of a confluence of factors, including a risky investment strategy, a widening hole in its balance sheet, and a purposeful attempt to hide its true financial health. It serves as a reminder of the importance of responsible banking practices and transparency in the industry.