White House Should Be Blaming CFTC for Crypto Market Woes

WH fails to realize issues that plague crypto aren't due to failure to adopt new measures but rather execute ones in place

Earlier today, on January 27th, 2022, the Biden administration published a press release on the White House site titled, "The Administration's Roadmap to Mitigate Cryptocurrencies' Risk", which can be found here.

This press release is weird. Let's walk down the curious strategy the White House pursued in this publication.

They begin by lamenting the fact that "2022 was a tough year for cryptocurrencies". That's a bit of an understatement, but sure.

From there, they only touch on one critical event by noting the implosion of a "so-called 'stablecoin'", which triggered a cascade of insolvencies in the crypto space.

That statement is followed up with the acknowledgment that "many everyday investors who trusted cryptocurrency companies - including young people and people of color - suffered serious losses...", which is where it gets awkward because it's likely that those two demographics were the ones that were impacted the least by the chaos. That aside, in this very specific instance, it seems strange to pick out two different demographics of peoples impacted by the fallout in the crypto markets as if their losses are somehow less acceptable than that of anyone else's (side note: The author of this piece is young and Black).

From there...the press release inserts an invisible middle finger to both the crypto industry and all those aforementioned folks who were impacted by the chaos of the crypto markets when it enigmatically pivots mid-sentence to say "but, thankfully, turmoil in the cryptocurrency markets has had little negative impact on the broader financial system to date". The statement makes it implicitly clear that despite acknowledging the life-altering losses countless American citizens suffered at the hands of the crypto sphere, it's really 'all good' at the end of the day because, after all, the good ol' USA financial system wasn't impacted by it. So, it really ain't that bad for real. You feel me? (in essence)

The Press Release Gets Worse From There

Despite acknowledging just how poorly things went in the crypto sphere last year, the press release failed to concretely pinpoint exactly what led to the fallout.

The press release goes on to state, "While cryptocurrency may be relatively new, the behavior we have seen some cryptocurrency companies exhibit and the risks posed by this behavior are not."

No additional hints are given as to what behavior in specific the White House is referencing but based on their promise in the following sentence to, "ensure that cryptocurrencies cannot undermine financial stability, to protect investors, and to hold bad actors accountable", it appears that they are referring to a crackdown on the improprieties by cryptocurrency companies.

Expansion of Power is Unnecessary

The press release explicitly calls out Congress, stating, "congress, too, needs to step up its efforts", then provides an example of what could only assume would qualify as 'stepping up its efforts' when citing a potential expansion of "regulators' powers to prevent misuses of customers' assets - which hurt investors and distort prices - and to mitigate conflicts of interest".

The fact is that these agencies have long since been imbued with the authority to impact regulation in this space in a meaningful fashion. In specific, the CFTC had the power to crack down on FTX's absurd proposal to serve as their own clearinghouse despite having nowhere near the expertise, capital or resources required to do so.

FTX was licensed and registered with the CFTC as a 'derivatives clearing organization' (DCO). As such, it was their responsibility to monitor and police the activities of the cryptocurrency exchange in the weeks and months leading up to its eventual collapse.

Since then, numerous observers have taken the time to zero in on the questionable behavior of the CFTC over the past few months. Notably, FTX had spent considerable time and resources in pushing forward an agenda to expand the regulatory powers of the CFTC over the crypto sphere (which is an initiative that's actually in accordance with what the Biden administration requested in their press release).

Probing into the Relationship Between FTX and the CFTC

At the end of November, the Washington Post published a critical, yet necessary piece that peered into the relationship between Samuel Bankman-Fried and Rostin Behnam, head of the CFTC.

The article notes that, "Since last year [2021], the two have worked in parallel on critical initiatives which, if not for the sudden demise of Bankman-Fried's FTX empire, might have radically altered the nation's attempts to govern the freewheeling market for digital currencies."

How, you ask? Through a bill, largely backed by Samuel Bankman-Fried and FTX, that sought to make the CFTC the de facto agency for all supervisory-related responsibilities for the cryptocurrency space.

As shown in the excerpt above from the WaPo piece, there are a number of eyebrow-raising facts surrounding the collaborated efforts of Samuel Bankman-Fried and the CFTC that suggest that further scrutiny is warranted by those in power whose job responsibilities include launching inquiries to investigate potential conflicts of interest or abdications of responsibility by government agencies (particularly regulating bodies like the CFTC).

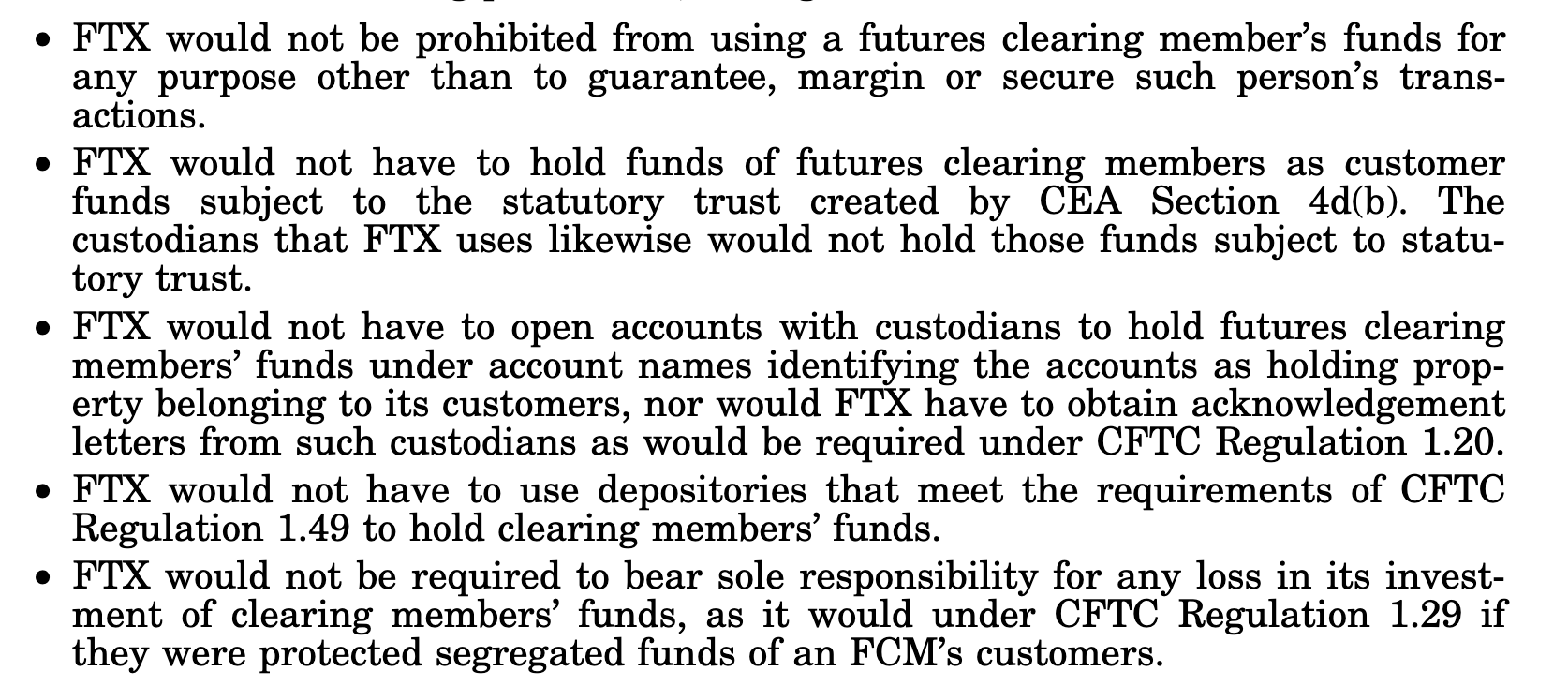

That idea aside, perhaps what's even more troubling is the fact that the CFTC refused to deny FTX's application to expand the derivatives offering on its FTX.US platform with its proposal of an 'automatic liquidation' machination to manage positions heading into default.

Relating This Back to the White House Press Release

A few paragraphs in, the press release makes mention of a report it commissioned to address the risks inherent in the cryptocurrency sphere.

Notably, this report is mentioned within the context of its admonishment of Congress, stating, "[Congress] could limit cryptocurrencies' risks to the financial system by following the steps outlined by the Financial Stability Oversight Council in its recent report."

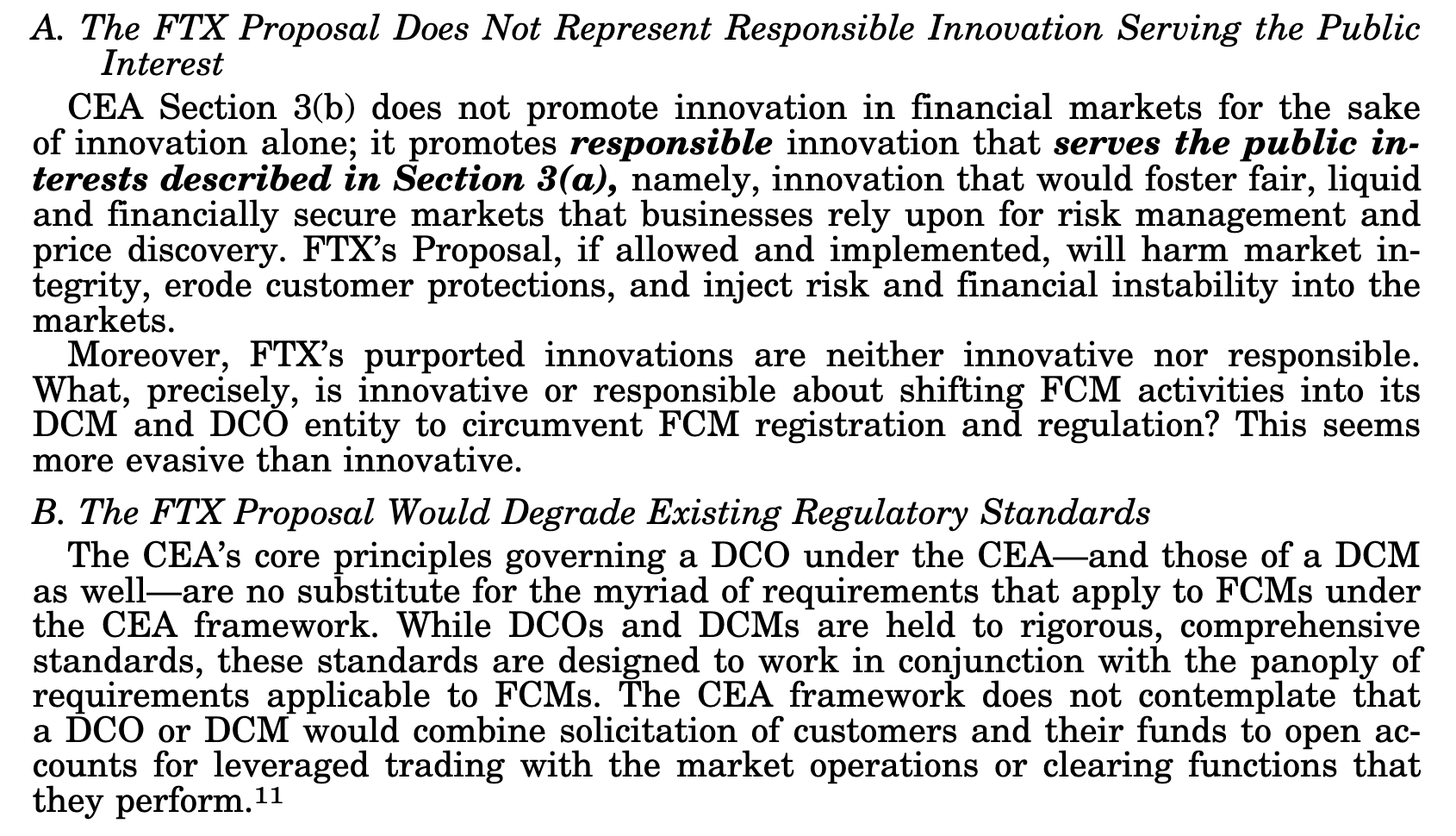

Ironically, it is that very same report that blasted the FTX.US derivatives expansion plan that the CFTC was apparently in love with.

In that excerpt above, the FSOC report did everything but call out FTX by name.

"Platforms typically use some level of collateral and then rely on auto-liquidations of that collateral when a position's value falls below some margin maintenance level" (this describes FTX's handling of derivatives precisely)

The mention of 'leveraged tokens' is an ode to FTX as well, since they invented & introduced them to the crypto markets.

Just in case these references aren't convincing enough, it's worth noting that there's an in-text citation hanging at the end of the paragraph appearing before the first one in the screenshot above that references documentation on FTX US' site detailing 'Spot Margin Trading'.

Beyond that and other mentions, a considerable portion of the report is dedicated to outlining the risks of crypto derivatives to U.S. consumers.

Among that content, the most relevant was the report's warning about "automated liquidation":

Summarizing the excerpt above:

The FSOC report explicitly notes that the 'method of liquidating leveraged positions can have substantial implications for whether the unwinding of those positions affects orderly market conditions'.

The report then very specifically singles out a method called 'automated liquidation', stating that when "combined with high leverage [it] potentially heightens financial stability risks" while also noting that the price behavior most crypto assets typically exhibit (high volatility) lends them to being more predisposed to triggering this liquidation mechanism relative to other traditional asset classes, thus heightening the dangers.

The report doesn't stop there. Following what you just read in the excerpt above, the FSOC report goes on to note that, "Automated liquidations without appropriate regulatory guardrails are likely procyclical, exacerbating balance sheet distress at a time of falling asset values and potentially creating a cascade of automated liquidations. Compared to alternative liquidation mechanisms, automated liquidation may cause lenders to be more likely to liquidate*.*"

Circling Back to FTX's Proposal with the CFTC

On March 12th, 2022, Samuel Bankman-Fried appeared in front of Congress on behalf of FTX to answer questions related to his exchange's "automatic liquidation" proposal that had been sitting with the CFTC since December 2021.

Below are excerpts from the transcript of Samuel Bankman-Fried's testimony during his opening statements to Congress at that hearing.

CME President Duffy Destroyed FTX's Proposal at the Hearing

Notably, this hearing also had some other major players in the derivatives industry there to weigh in on FTX's proposed "auto-liquidation" feature.

One particularly outspoken member of that panel was the Chairman and CEO of the CME Group, Terry Duffy.

Rather than offer commentary on Duffy's testimony, this piece will defer to his actual statements, shown in the screenshots below.

Duffy Carves Up FTX's Auto-Liquidation Proposal Too

Duffy Even Called Out the Conflicts of Interest Between FTX and Alameda

One observation that will be noted here from the excerpt depicted in the above screenshot is the fact that Duffy very specifically called on the CFTC to investigate the conflicts of interest between Samuel Bankman-Fried and Alameda, while also noting the issues inherent in the firm's relationship with FTX that warranted such scrutiny.

Statements of note from the above screenshot:

"FTX heralds its use of backstop liquidity providers as a prudent liquidity risk management tool that can be utilized where auto-liquidation fails. FTX does not identify those potential backstop liquidity providers. We can only speculate on who they are and their relationship to FTX.

"It is worth noting that Alameda Research, which has common ownership with FTX and was originally founded to exploit cross-border crypto arbitrage opportunities, plays a significant role in managing liquidations and providing liquidity in offshore and cash crypto markets. It is important for market stakeholders and the CFTC to investigate these unknowns further in light of the clear conflicts of interest of such a structure."

Duffy Outlines All the Risks FTX's Proposal Created for Customers

This part of his testimony is where he really elucidated the dangers customers at FTX were facing:

Duffy's Closing Statements Finishing Off FTX

Yeesh.

White House's Press Release Shows They Have No Clue What's Going On

When considering all that was written above, it's clear that the solution to the crypto space's woes is not 'expanding regulatory powers', but rather holding them accountable to exercise those powers effectively.

Proposing sweeping changes and enforcement measures as part of knee-jerk reaction to shocking news in the crypto space without truly probing into the heart of the issue is an irresponsible move by the White House.

In parting - consider the fact that this piece you just read was written by one random individual in the crypto space. This was not assisted or informed by any team, agency, or group. These findings and conclusions are the result of independent, non-financed efforts.

With that being said, how much easier should it be for the White House to ascertain what's going on in the crypto sphere so that they can react accordingly? Granted, there's certainly a lot more than crypto on the White House's plate, but given the fact its important enough for them to commission multiple reports and press releases addressing the industry in the space of less than a year, one can strongly argue that perhaps the White House needs to start pointing the finger at itself rather than everyone else.